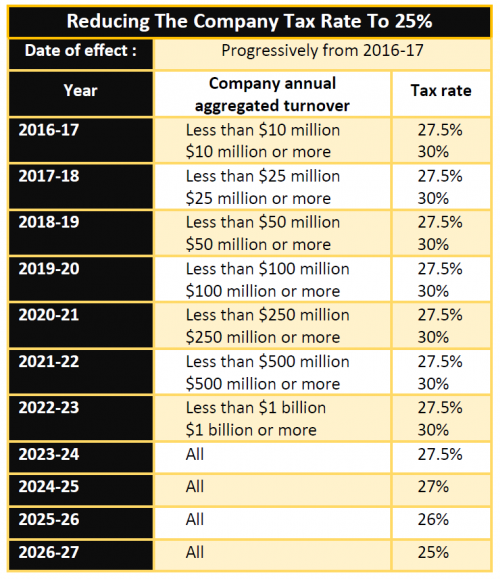

Company Tax Rate 2024 Australia

Company Tax Rate 2024 Australia – The policy means that in the small number of instances when a large multinational company’s effective Australian tax rate falls below 15 per cent, the Tax Office will charge a top-up payment. . To help you kick start your money momentum in the new year, I cover five tactics you can use to create $84,222 of tax deductions in 2024 interest rates, owning an average Australian property .

Company Tax Rate 2024 Australia

Source : www.velocityaccounting.com.au

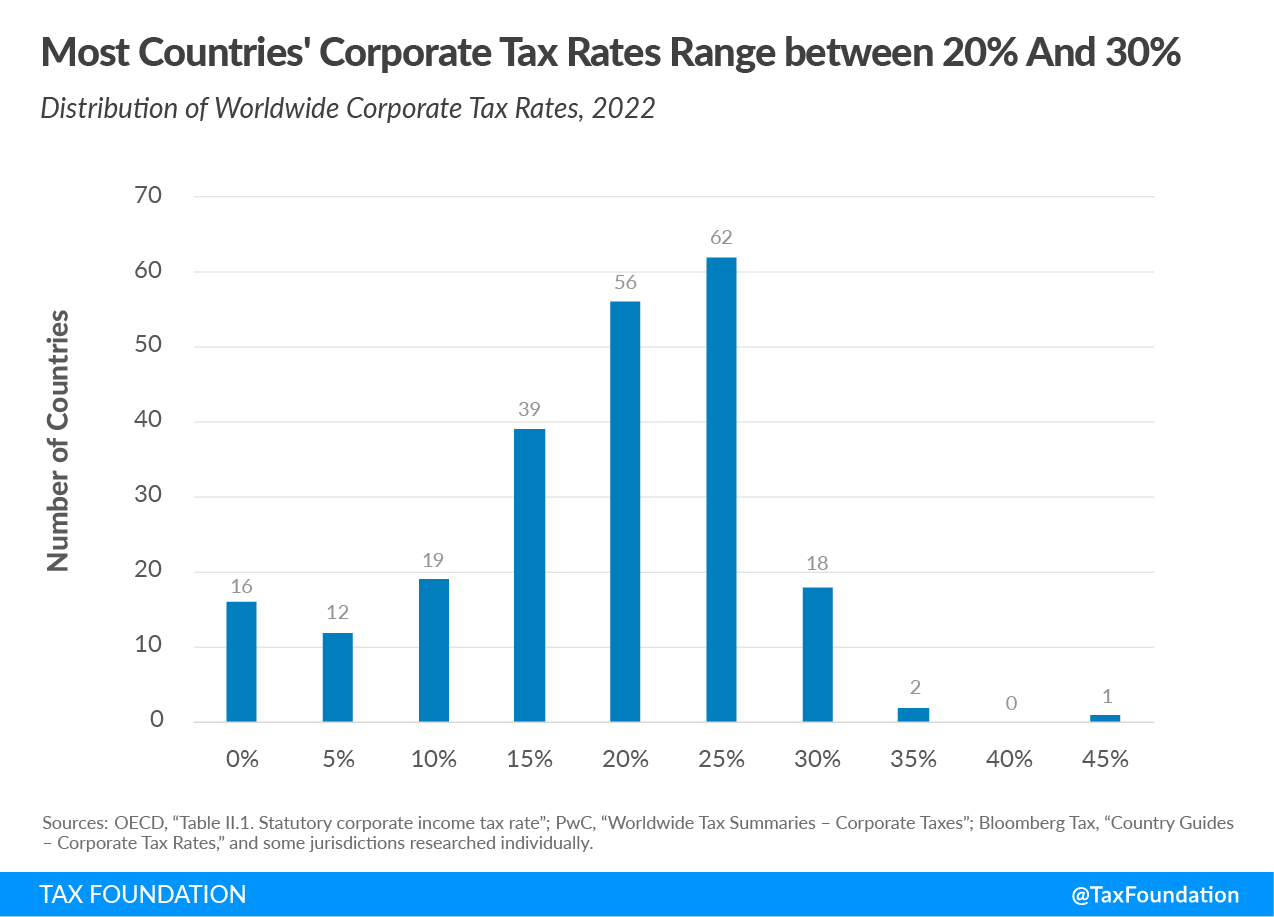

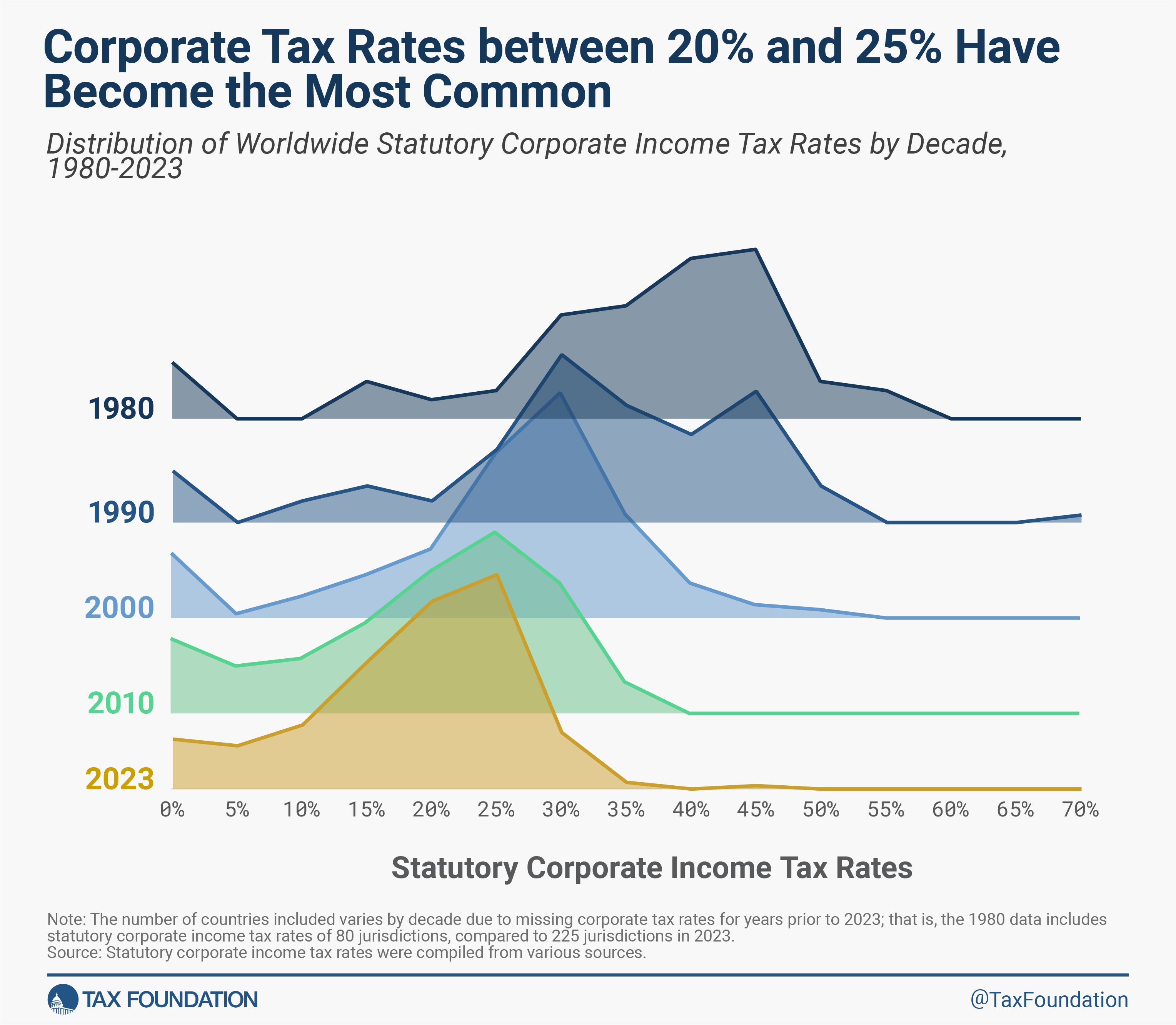

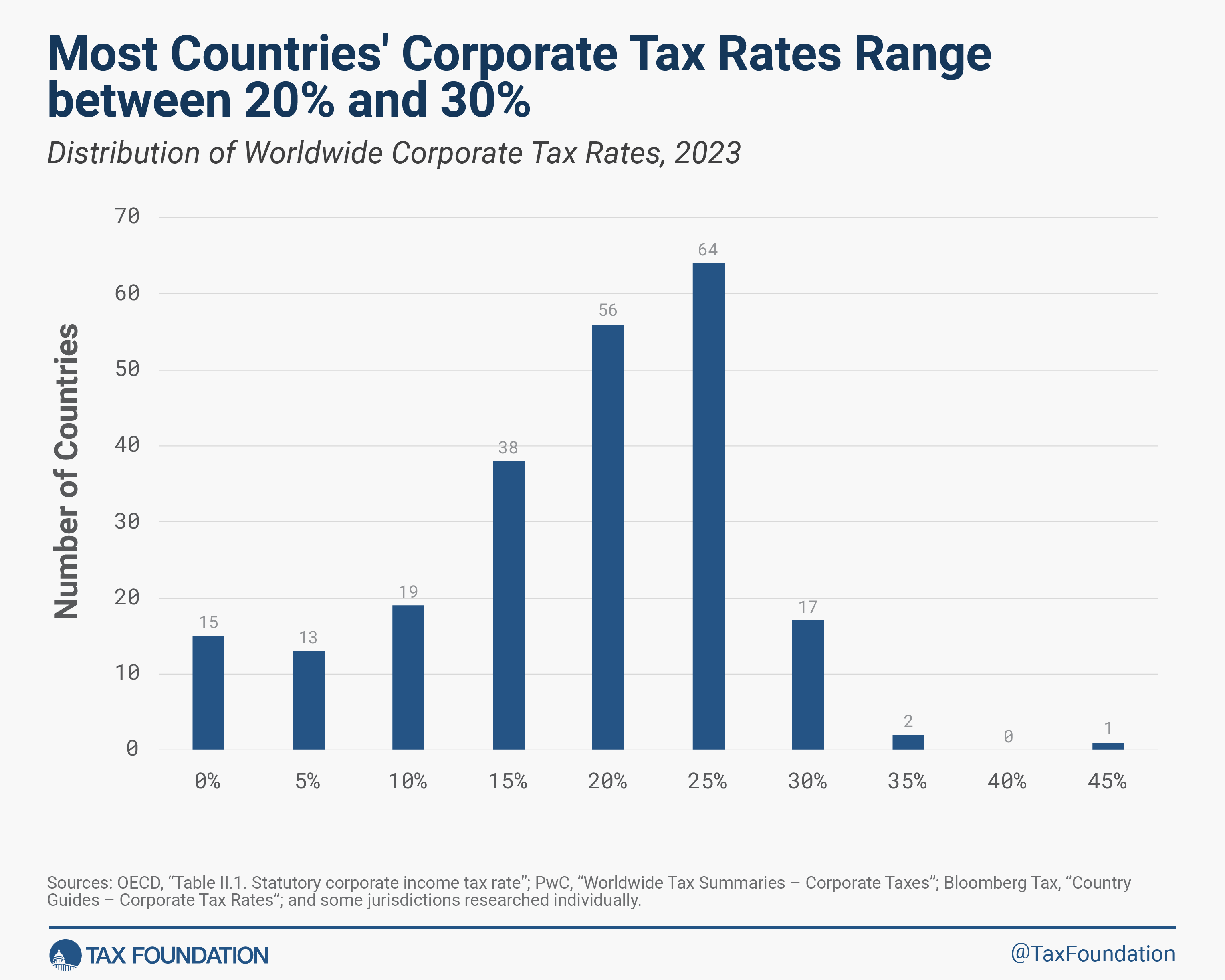

Corporate Tax Rates by Country | Corporate Tax Trends | Tax Foundation

Source : taxfoundation.org

Your Ultimate Australia Crypto Tax Guide 2024 | Koinly

Source : koinly.io

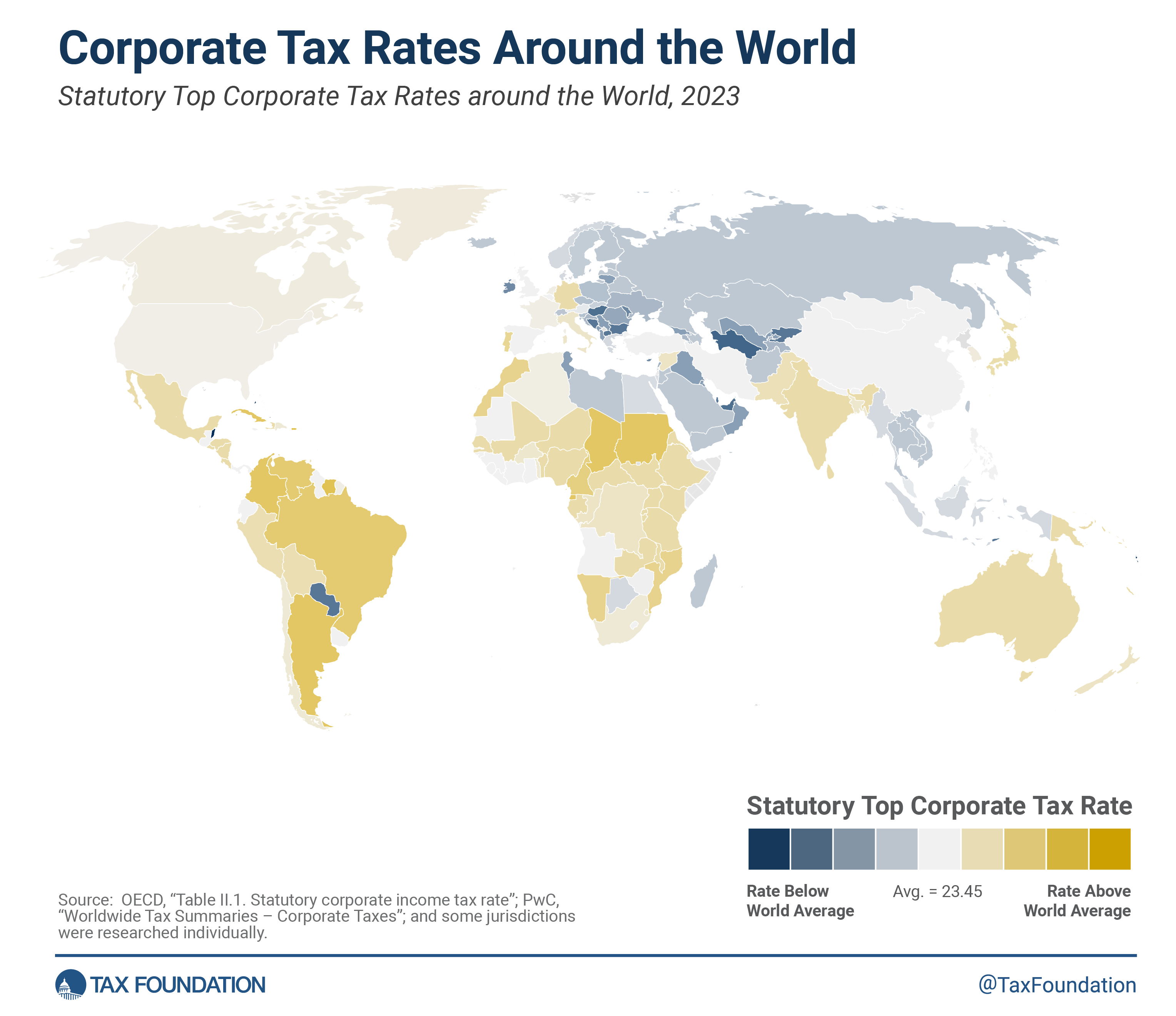

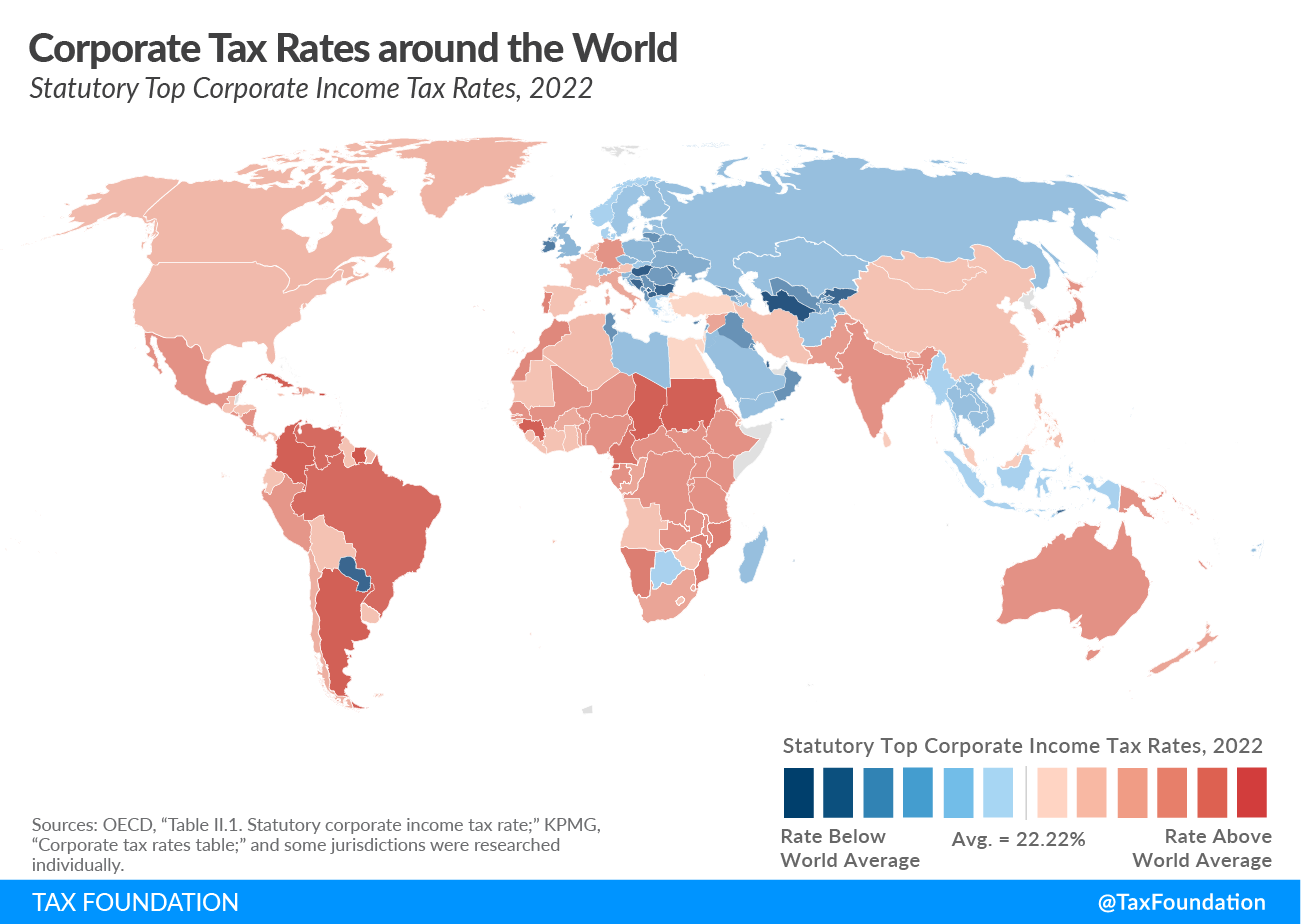

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Your Ultimate Australia Crypto Tax Guide 2024 | Koinly

Source : koinly.io

Corporate Tax Rates by Country | Corporate Tax Trends | Tax Foundation

Source : taxfoundation.org

2023 Corporate Tax Rates in Europe | Corporate Income Tax Rates

Source : taxfoundation.org

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

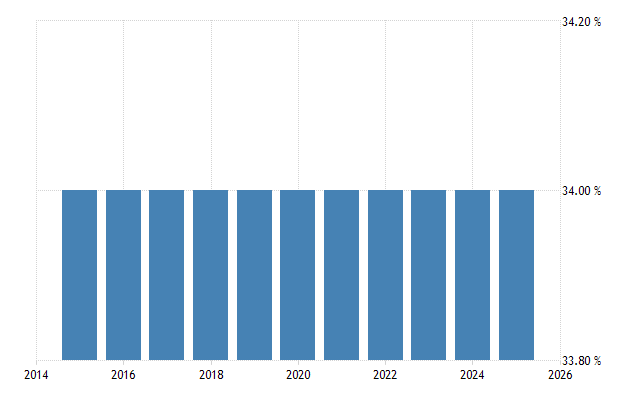

Brazil Corporate Tax Rate

Source : tradingeconomics.com

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Company Tax Rate 2024 Australia Velocity Accounting Reductions In The Corporate Tax Rate: Aussie travellers will soon be hit by a new tax South Australia state director Dr Victoria Cock said. Public spaces like Adelaide’s Glenelg Jetty will become smoke-free zones in 2024. . Franked dividends are profits the company has already paid tax at the Australian company tax rate of 30% before distributing dividends. Because tax has already been paid, the shareholder can claim .