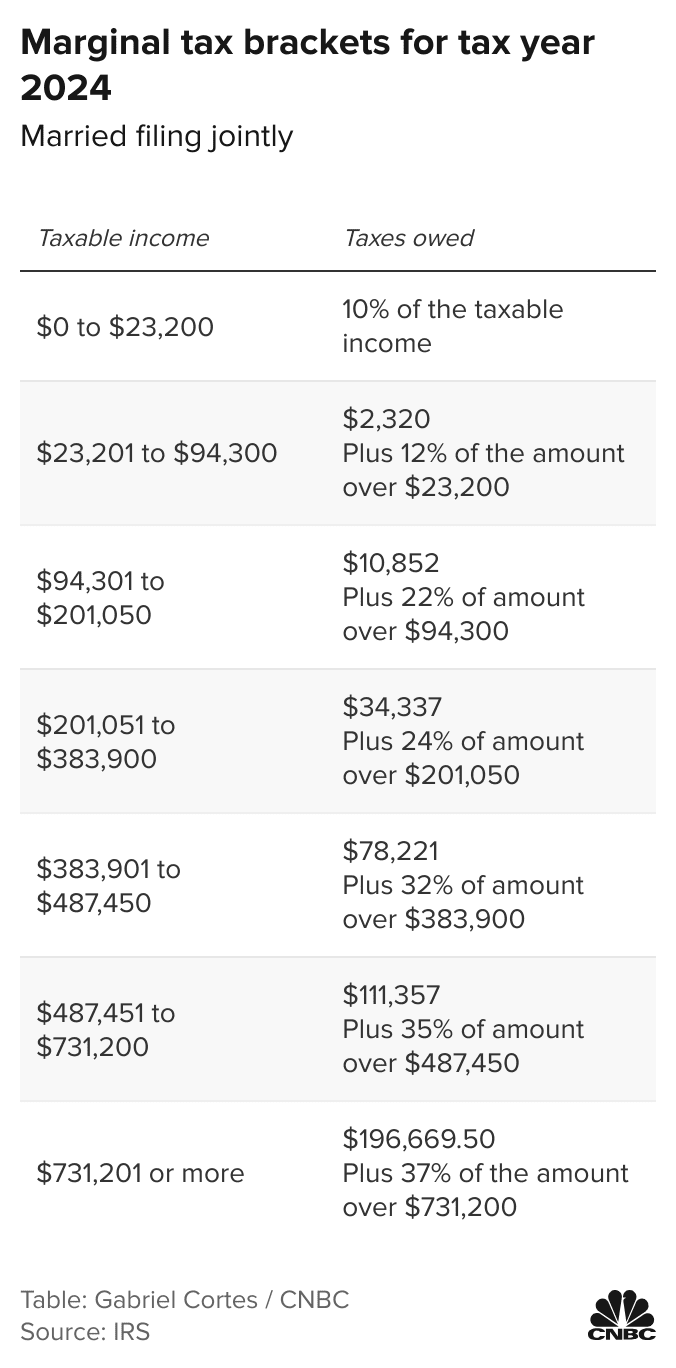

Tax Brackets 2024 Married Jointly California

Tax Brackets 2024 Married Jointly California – What taxes will you owe on your capital gains? With a big year in the stock market in 2023 you could be facing a large tax bill. . For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

Tax Brackets 2024 Married Jointly California

Source : www.cnbc.com

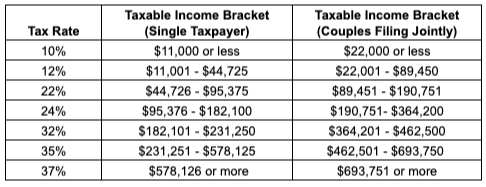

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

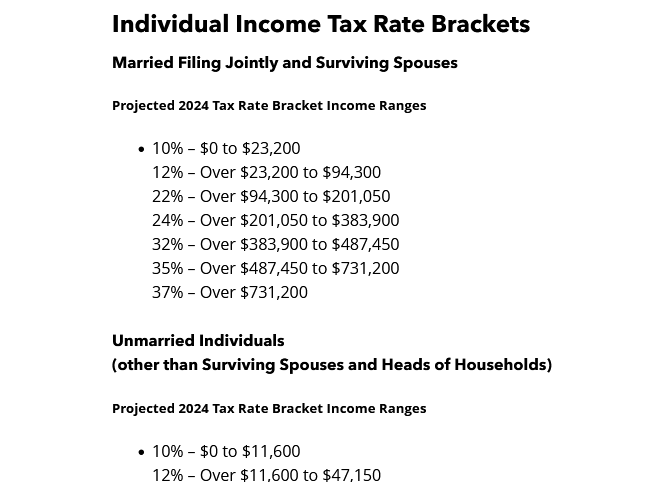

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

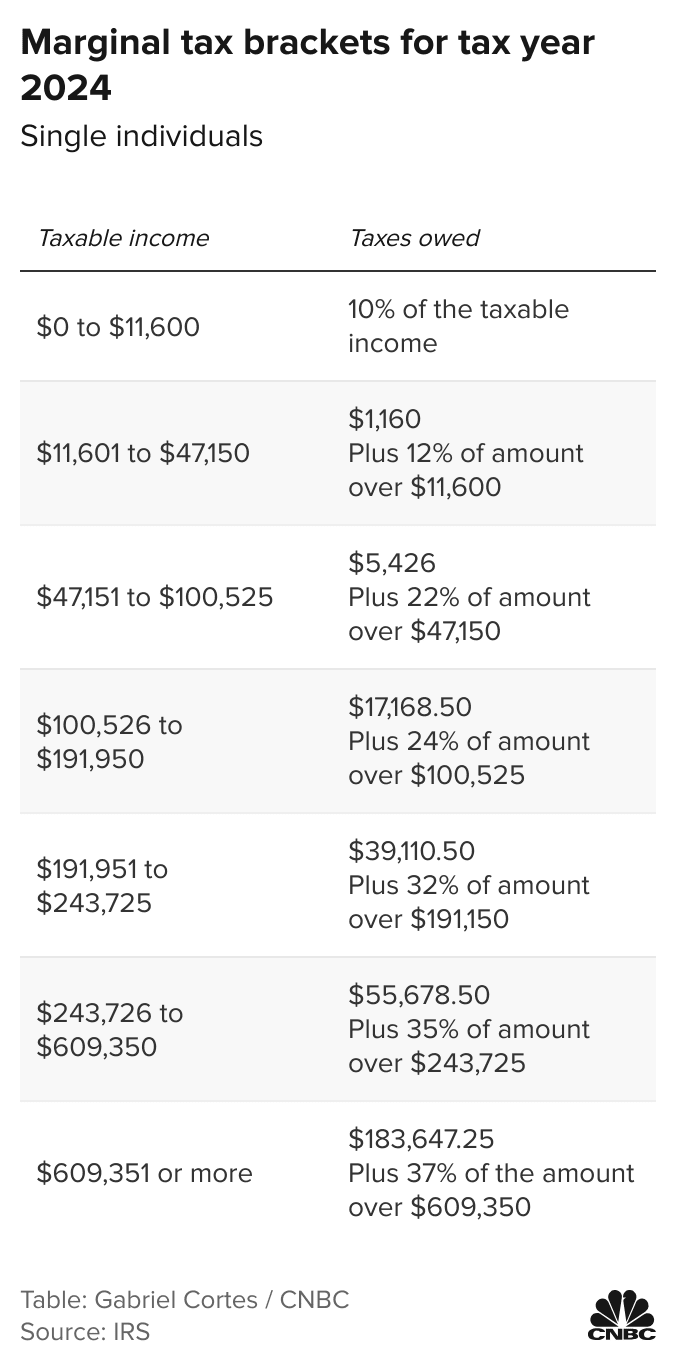

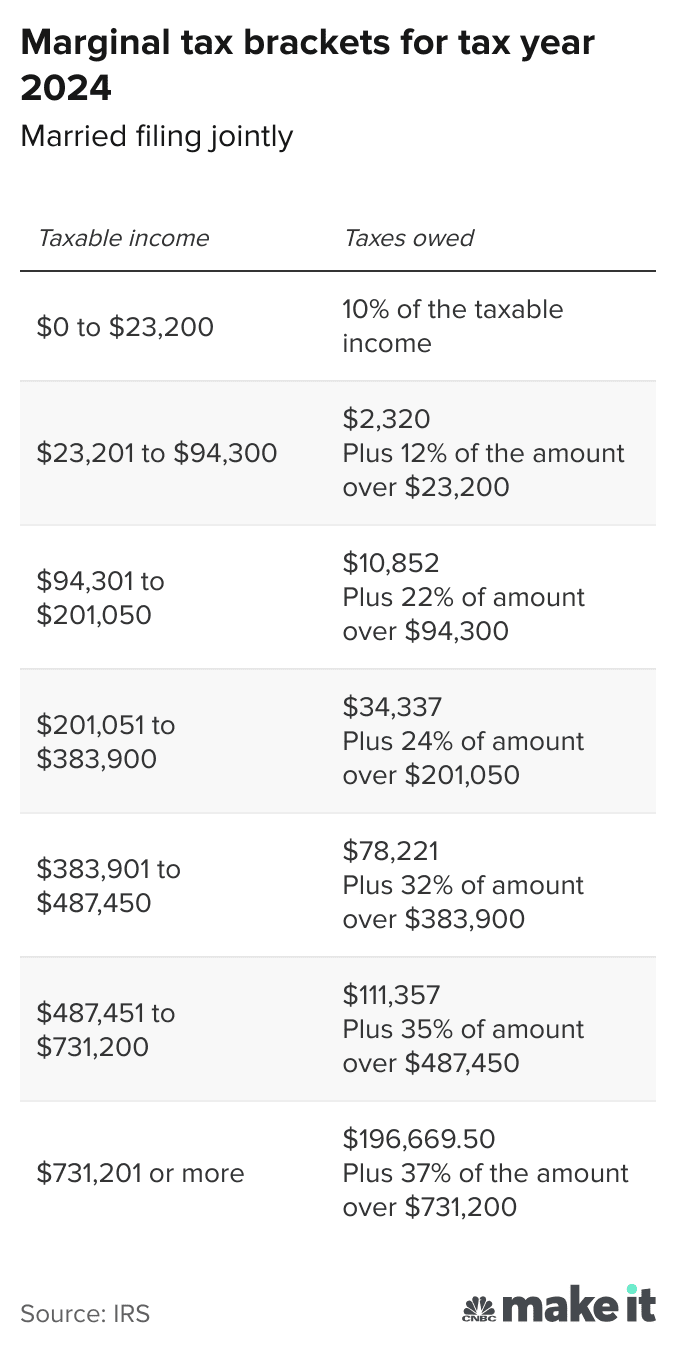

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

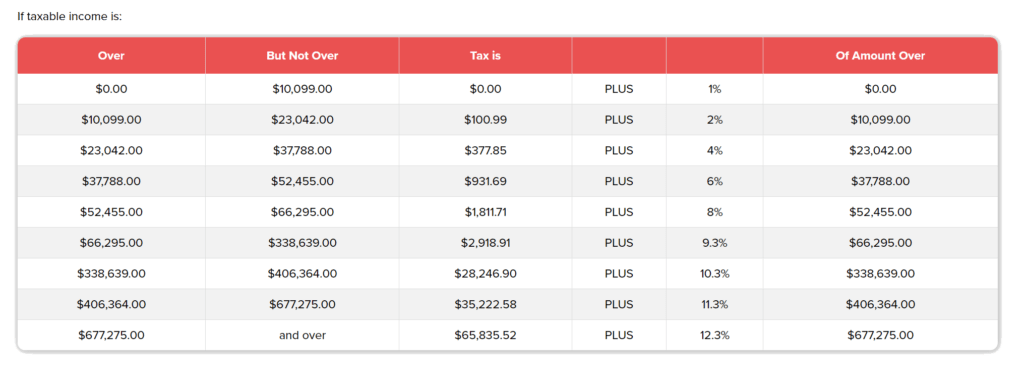

Know Your California Income Tax Brackets Western CPE

Source : www.westerncpe.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

Shehan on X: “2024 tax brackets https://t.co/mNQ6cbFAka” / X

Source : mobile.twitter.com

Tax Brackets 2024 Married Jointly California IRS: Here are the new income tax brackets for 2024: There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . Many of us have heard that getting married comes with all sorts of tax benefits. So, why would it ever make sense not to choose the married filing jointly status Cicely Jones (CA Insurance Lic. #: .